So, what is wholesale price index and how it can help you make better investment decisions? The definition suggests, a WPI is a measure of inflation that tracks prices at early stages of a transaction. The wholesale price index gives an idea of the average change in the price of bulk commodities at the wholesale level, which means the price at the producers and traders' level. The WPI index consists of prices of three broad categories—primary items, fuel and power, and manufactured products. It measures selected items and publishes indices which form the basis in the market.

Since it is a measure of inflation, it is calculated in percentage against a base year. The number and character of the commodities included in wholesale price indexes vary widely from country to country. In large industrial countries like the United Kingdom, the United States, and Germany, the commodities that are included usually number in the thousands; but for most countries it is much smaller, often only 100 or 200.

The smaller numbers of products will serve well enough if only a general all-commodities index is wanted. The commodities are also grouped into 15 categories and nearly 100 subgroups (fresh fruits, grains, etc.) and a large number of product classes (apples, bananas, barley, corn, etc.), for each of which monthly price indexes are published. In addition, there are a number of indexes for special commodity groups such as various categories of pharmaceutical preparations.

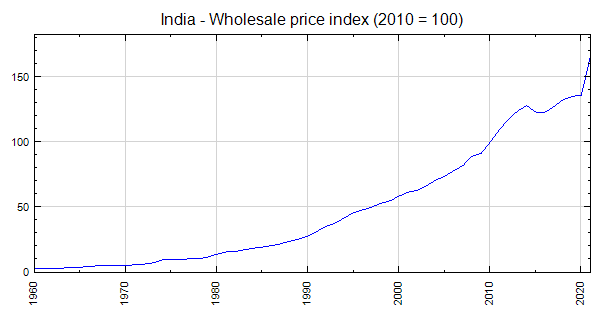

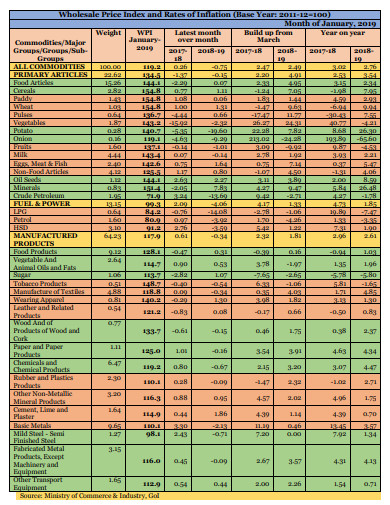

The number of commodities included in the U.S. index has expanded from 250 when the index was started in 1902 to about 2,400 in the late 20th century. The new commodities have tended to be more highly fabricated and to have more stable prices, and they have therefore dampened the fluctuations in the index. One reason for the inclusion of more commodities was a gradual shift in the conception of the function of the index. Originally it was regarded as a measure of movements in the general price level, but as other indexes became available, such as the consumer price index, less reliance was placed on the wholesale price index for this purpose. At the same time, there was a growing demand for subindexes pertaining to particular classes of products for various business and analytical purposes. The wholesale price inflation rate in India eased to 11.16 percent year-on-year in July 2021, from 12.07 percent in the previous month and slightly below market expectations of 11.30 percent.

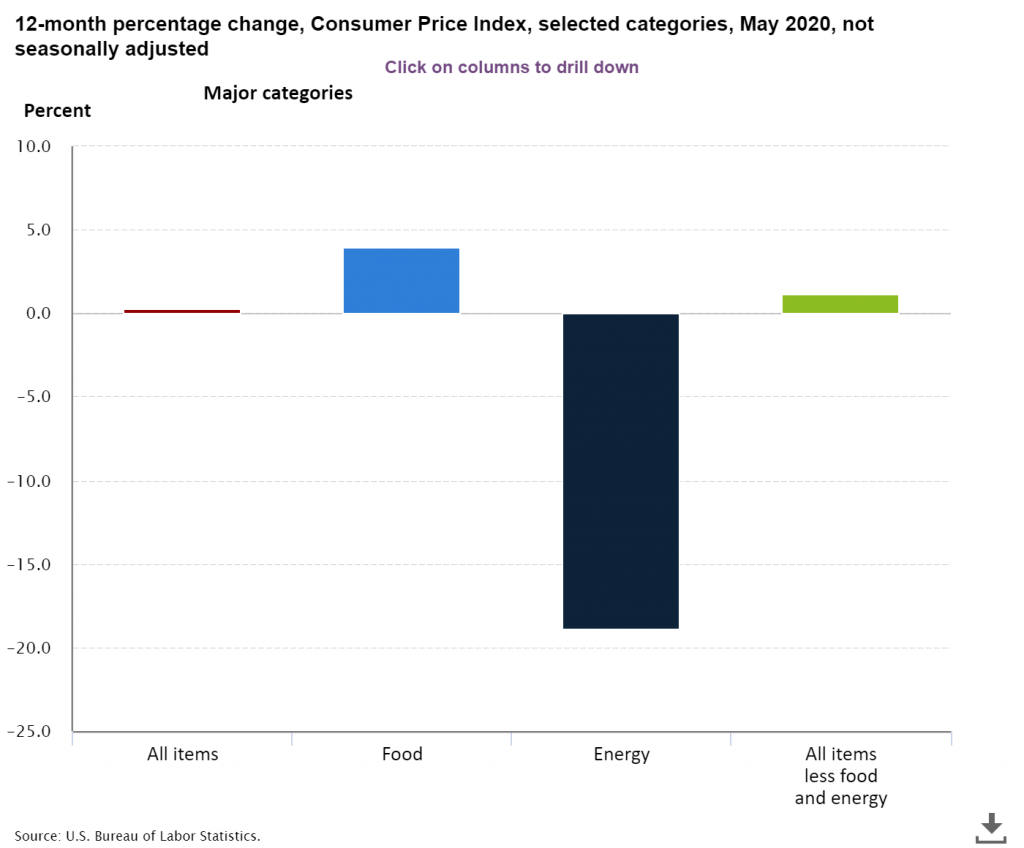

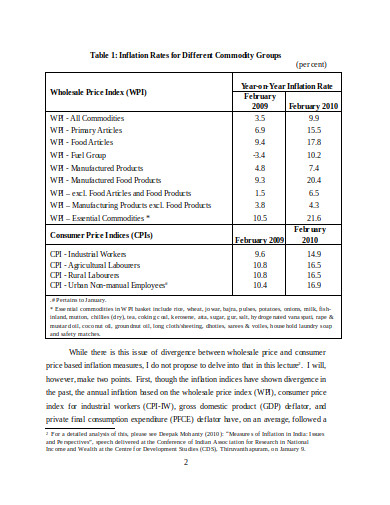

Cost for primary articles advanced at a softer pace (5.72 percent vs 7.74 percent) as food articles were unchanged (vs 3.09 percent in June) while non-food articles inflation accelerated (22.94 percent vs 18.86 percent). In addition, prices of fuel & power advanced 26.02 percent, slower than 32.83 percent in June; while manufactured products inflation rose to 11.20 percent from 10.88 percent. On a monthly basis, wholesale prices increased by 0.6 percent in July, the same pace as in the previous month. A price index is a measure of the proportionate, or percentage, changes in a set of prices over time. A consumer price index measures changes in the prices of goods and services that households consume. Such changes affect the real purchasing power of consumers'incomes and their welfare.

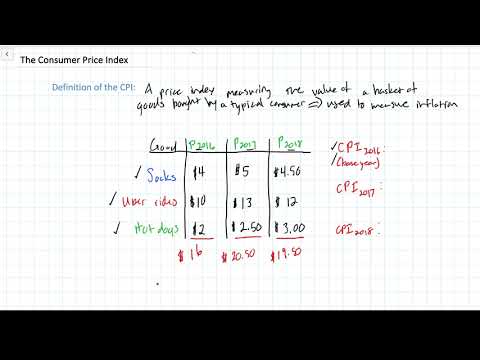

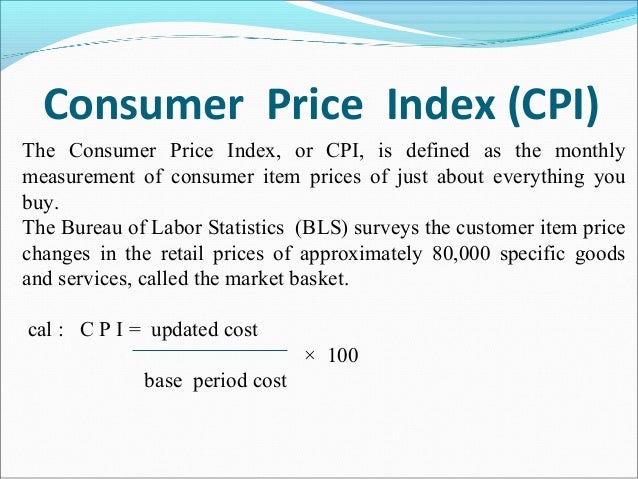

As the prices of different goods and services do not all change at the same rate, a price index can only reflect their average movement. A price index is typically assigned a value of unity, or 100, in some reference period and the values of the index for other periods of time are intended to indicate the average proportionate, or percentage, change in prices from this price reference period. Price indices can also be used to measure differences in price levels between different cities, regions or countries at the same point in time. Consumer price indices are index numbers that measure changes in the prices of goods and services purchased or otherwise acquired by households, which households use directly, or indirectly, to satisfy their own needs and wants.

Consumer price indices can be intended to measure either the rate of price inflation as perceived by households, or changes in their cost of living . In practice, most CPIs are calculated as weighted averages of the percentage price changes for a specified set, or ''basket'', of consumer products, the weights reflecting their relative importance in household consumption in some period. Wholesale prices in India rose by 12.94 percent year-on-year in May 2021, accelerating from a 10.49 percent gain a month earlier and compared with market consensus of 13.07 percent.

This was the highest wholesale inflation rate since December 1998, amid low base effect last year, when the coronavirus pandemic weighed on demand and prices. FD-ID indexes are constructed from commodity-based producer output price indexes. These commodity-based output price indexes are allocated to aggregate categories based on proportions of use by type of buyer. The main source of data used to determine buyer type is the table titled "Use of commodities by industries, before redefinition" from the Benchmark Input-Output Data Tables of the United States, produced by the U.S. The two primary classes of buyers included in the FD-ID system are final demand and intermediate demand . In many cases, the same commodity is purchased by different buyer types, so commodities are often included in several FD-ID indexes.

For example, regular gasoline is purchased for personal consumption, export, government use, and business use. The PPI program publishes only one commodity index for regular gasoline, reflecting sales to all types of buyers. In some cases, buyer type is an important price determining characteristic, and results in commodity indexes being created on that basis. For example, within the PPI category for loan services, separate indexes for consumer loans and business loans were constructed. In this case, the commodity index for consumer loans would be included in the final demand index and the commodity index for business loans would fall under intermediate demand.

Annual wholesale price inflation rate in India edged up to 11.39 percent in August of 2021, from 11.16 percent in the previous month, above market forecasts of 10.75 percent. Inflation accelerated for the first time in 3 months, led by fuel and power (26.09% vs 26.02% in July), primary articles (6.2% vs 5.72%), manufactured products (11.39% vs 11.2%) and chemicals (12.14% vs 11.13%) but eased for food (3.43% vs 4.46%). The price index is an indicator of the average price movement over time of a fixed basket of goods and services.

The formation of the basket of goods and services is done keeping into the consideration, whether the changes are to be measured in retail, wholesale or producer prices. At present, separate series of index numbers are compiled to capture the price movements at retail and wholesale level in India. The Wholesale Price Index number is a measure of average wholesale price movement for the economy. Price stability is one of the key objectives of every macroeconomic policy formulation in an economy as it helps stabilize nominal interest rates, thereby promoting higher investment and growth.

High levels of inflation, or price instability, may reduce purchasing power in future and therefore may adversely affect savings, investment and economic growth. Inflation may also increase the chances of higher business risk and lower export competitiveness. The most commonly cited indices are Wholesale Price Index which is a measure of average change in wholesale prices of goods in the economy and Consumer. The deflation of nominal wages by the Consumer Price Index provides a measure of the purchasing power of wages at constant prices.

If prices rise more rapidly that wages, the commodity income (i.e. the real value of goods and services purchased with money income, also called real income) will decrease. The same is true in the opposite case when wages rise more rapidly than prices. Thus, below or above the certain limits of fall or rise in the level of real wages the comparison itself tends to become irrelevant in view of the altered market basket in the current situation.

In fact, if the estimated index numbers of real wages exhibit a sharply rising or falling tendency, this in itself may be taken as an indication that the Consumer Price Index series used has outlived its utility. Although there are various methods to calculate inflation, inflation is always measured with reference to Consumer Price Index or Wholesale Price Index . Consumer Price Index is a price index which represents the average retail price of the baskets of goods over time. Wholesale Price Index is a price index which represents the wholesale price/bulk trading price of a basket of goods over time.CPI is regarded as a better measure of actual cost of living.

Inflation is expressed as a percentage change in the value of these indices over a period of time. The Wholesale Price Index is the price of a representative basket of wholesale goods. The Wholesale Price Index or WPI is "the price of a representative basket of wholesale goods". Some countries use the changes in this index to measure inflation in their economies, in particular India – The Indian WPI figure was earlier released weekly on every Thursday and influenced stock and fixed price markets. The Wholesale Price Index focuses on the price of goods traded between corporations, rather than goods bought by consumers, which is measured by the Consumer Price Index. The purpose of the WPI is to monitor price movements that reflect supply and demand in industry, manufacturing and construction.

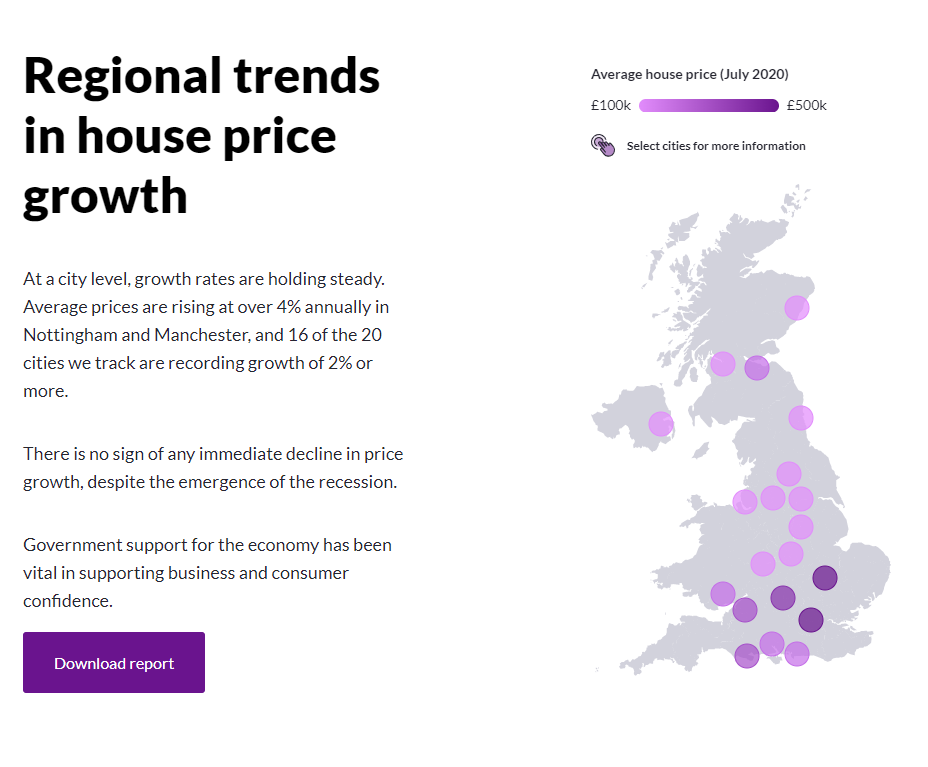

This helps in analyzing both macroeconomic and microeconomic conditions. Wholesale prices in India rose by 12.07 percent year-on-year in June 2021, below market consensus of a 12.23 percent rise, and easing from a near 22 ½-year high of 12.94 percent gain a month earlier. While WPI represents the wholesale prices of goods, CPI indicates the average price paid by households for a basket of goods and services. Four kinds of CPIs are released namely CPI for urban non-manual employees, industrial workers, agricultural labourers and CPI for rural labourers. Even the wealth managers use inflation calculated based on CPI for the financial planning because CPI is based on price that consumer pay. In the wholesale price index, primary articles, fuel & power and manufactured goods are included.

Fuel and power include electricity, coal mining, mineral oil and more. Manufactured goods include beverages, tobacco products, wood products, paper products, textiles, basic material, rubber and rubber products etc. The list of manufactured products can be as long as 500 items or even more.

This is a source of upward bias in the general wholesale indexes since there is reason to believe that technological change has been particularly important in bringing about improvements in complex goods. In India there are various price indices such as index of retail prices, index of wholesale prices, cost of living index of industrial workers, export prices, and so on. A separate index number can be calculated to measure changes in each price level.

Wholesale Price Index WPI is a measure of average wholesale price movement for the economy. It measures the average change in prices of commodities for bulk sale at the level of early stages of transaction. Wholesale Price Index represents the price of representative commodity basket of 697 items at the wholesale level, i.e. goods traded in bulk and between organizations, not the end consumers. The significant components of WPI include Manufactured Products, Primary Articles, Fuel, and Power in the decreasing order of weight-age to the stated elements. The purpose of the WPI is to monitor price movements that reflect supply and demand in industry, manufacturing, and construction. The WPI index helps in analyzing both macroeconomic and microeconomic conditions.

Some countries such as India and Philippines use WPI to measure the inflation. They calculate inflation as percentage change in WPI for that period. CPI is also used in different countries, however, with different names.

WPI is released by the Economic Advisor in the Ministry of Commerce and Industry. The purpose of WPI is to inspect movement in prices of goods that reflect supply and demand in industry, construction and manufacturing. The index basket of WPI categorises commodities under three groups — primary articles, fuel and power & manufactured products.

While WPI keeps track of the wholesale price of goods, the CPI measures the average price that households pay for a basket of different goods and services. Even as the WPI is used as a key measure of inflation in some economies, the RBI no longer uses it for policy purposes, including setting repo rates. The central bank currently uses CPI or retail inflation as a key measure of inflation to set the monetary and credit policy. A wholesale price index is an index that measures and tracks the changes in the price of goods in the stages before the retail level.

This refers to goods that are sold in bulk and traded between entities or businesses . Usually expressed as a ratio or percentage, the WPI shows the included goods' average price change; it is often seen as one indicator of a country's level of inflation. It is worthwhile to note that there are different ways to measure inflation. The 'Consumer Price Index ' looks at the basket of consumer goods and services and measures the change in price of this basket over a period of time.

This was the most widely used inflation measure for policy purposes in India until 2014 which was then changed to the CPI by Dr Raghuram Rajan, the then Governor of the Reserve Bank of India . A price index is nothing, but one that reflects the changes of prices over a period of time. Thus, in India to measure wholesale price index , a monthly wholesale price index is computed. For example for the month of August the WPI inflation came in at at 3.59 per cent, the lowest in the last 5 years. Consumer Price Index or CPI is an index that measures the average retail price of consumer goods and services. These goods and services range from food items to medical care and transportation.

Generally, there are eight categories included in the consumer price index. These categories are – Foods, Beverages, Medical Care and Recreation, Communications, Education, Garment, Transportation, and Housing. It helps to actively to pinpoint the inflation and deflation cycle in the economy.

The Producer Price Index measures the average change in prices U.S. producers receive for the sale of their products. Since tariffs and taxes are not retained by producers as revenue, they are explicitly excluded from the PPI. However, pricing decisions producers make in reaction to tariffs are included in the PPI. For example, if a domestic producer is manufacturing a product that is subject to import competition and tariffs are placed on those imports, the domestic producer may increase its own prices in order to maximize revenue. In this case, the price increase for the domestic producer would be included in the PPI. Effective with the January 2014 PPI data release in February 2014, BLS transitioned from the Stage of Processing to the Final Demand-Intermediate Demand (FD-ID) system.

The transition to the FD-ID system is the culmination of a long-standing PPI objective to improve the SOP aggregation system by incorporating PPIs for services, construction, government purchases, and exports into the primary aggregation structure. In comparison to the SOP system, the FD-ID system provides for an increase of over 150 percent compared with current PPI coverage of the United States economy in its primary aggregate indexes, to over 75 percent of in-scope domestic production. Nearly all new FD-ID goods, services, and construction indexes provide historical data back to either November 2009 or April 2010, while the indexes for goods that correspond with the historical SOP indexes go back to the 1970s or earlier. To improve the precision of PPI estimates of price change, sampled items are weighted by a measure of their size and importance. In the first stage of PPI computation, price indexes are constructed for narrowly-defined groupings of goods or services.

The individual items included in these indexes are weighted by the producing establishment's revenue for the product line. In the second stage of PPI computation, indexes for individual goods and services are combined into aggregate indexes. Data for weighting together the product-line indexes comes primarily from the economic censuses of the Bureau of Census. While the Consumer Price Index-based retail inflation — the more widely tracked policy tool — looks at the price at which the consumer buys goods, the WPI tracks prices at the wholesale, or factory gate/mandi levels. Between the wholesale price and the retail price, the difference essentially is the former only tracks basic prices devoid of transportation cost, taxes and the retail margin etc. Wholesale-level inflation — measured by the WPI or the wholesale price index — shot up to 7.39 per cent in March on a year-on-year basis.

This is the highest wholesale inflation rate since October 2012, and was driven largely by higher prices of crude oil and a surge in price levels of food items such as pulses and fruits. A Producer Price Index for an industry is a measure of changes in prices received for the industry's output sold outside the industry . The PPI publishes approximately 500 industry price indexes in combination with over 4,000 specific product line and product category sub-indexes, as well as, roughly 500 indexes for groupings of industries.

North American Industry Classification System index codes provide comparability with a wide assortment of industry-based data for other economic programs, including productivity, production, employment, wages, and earnings. Products and their specification both in terms of quality and technology are changing even faster. This makes it increasingly difficult to obtain the price information of selected products for a fixed number of quotations over a longer period of time.